Health Insurance vs. Medical Cost Sharing

This blog explores the differences between traditional health insurance and medical cost-sharing programs, highlighting their respective benefits and drawbacks.

Key Takeaways:

- How Traditional Health Insurance Works

- How Medical Cost-Sharing Works

- Which Option Suits You Best

- Downloadable Health Insurance vs. Medical Cost-Sharing Comparison Chart

- Optimal teleHealth’s Cost-Sharing Approach

Understanding Traditional Health Insurance:

Historically, traditional health insurance has been a commonly chosen option for individuals seeking financial protection against major medical expenses. Over time, however, the cost of health insurance has risen faster than the cost of medical services. This increase has led to more financial responsibility being shifted to policyholders through higher deductibles and co-payments.

While the insurance industry may attribute these increases to rising medical costs, it’s important to note that profit margins of insurance companies also play a significant role. Understanding the mechanics of health insurance is crucial in grasping why it can be perceived negatively by consumers.

One of the challenges with traditional health insurance is its complexity, often leading to a lack of clarity regarding costs until the final bill is received. This complexity, coupled with annual policy renewals that often come with rate increases, contributes to consumer frustration.

General Terms of Traditional Health Insurance Defined:

- Deductible: The amount of money an insurance policyholder must pay out-of-pocket every year before the insurance begins to provide financial support for major medical services. The deductible for an average individual policy is between $5,000 and $6,000, twice that for a couple.

- Co-Insurance: The percentage of major medical expenses the policyholder must pay after the annual deductible amount is paid. Co-insurance stops when the policyholder has paid the annual policy maximum out-of-pocket.

- Co-Payment: A different type of expense sharing where the policyholder pays an initial amount out-of-pocket for each service they receive. Commonly applicable to a consultation with a primary care physician, but also applies to the cost of other services such as emergency room, imaging and lab services and the nightly cost of an overnight stay in a hospital.

- Annual Maximum: A maximum limit on out-of-pocket expenses for a policyholder. This maximum is controlled by the government, and like deductibles, it’s twice as high for couples as it is for an individual. An average plan has an individual max of around $9,500 and $18,500 for a couple.

- Premium: The monthly cost of an insurance policy.

- Pre-Existing Conditions: Since passage of the Affordable Care Act, all health insurance plans are required by law to cover pre-existing conditions.

Understanding Medical Cost-Sharing:

Another approach to managing healthcare expenses is through medical cost-sharing, which has been in practice for about 30 years. This model involves non-profit organizations formed by like-minded individuals seeking an alternative to traditional health insurance. Members become cash-pay patients for medical services, with providers typically willing to invoice patients, allowing them time to be reimbursed by their cost-sharing community.

While medical cost-sharing may initially seem complicated to some, it offers clarity once the process is understood. It’s essential to recognize that it operates as a membership rather than insurance, with members sharing medical expenses based on trust rather than legal obligation.

When considering joining a medical cost-sharing community, it’s prudent to evaluate factors such as the community’s history of meeting monthly sharing requirements. There can be significant differences between communities, particularly in areas such as maximum annual or lifetime sharing limits and how they treat membership for people with pre-existing conditions. These communities prioritize full disclosure to ensure members are well-informed about their guidelines and operations.

General Terms of Medical Cost Sharing Memberships Defined:

- Non-Shareable Amount: Medical cost sharing communities create their own language to some extent, to help distinguish them from insurance plans. The various sharing communities provide for payment of a certain level of out-of-pocket expense for the member before they can begin sharing expenses with the community. One major community calls it Annual Household Portion (AHP) and another Initial Unshareable Amount (IUA), but conceptually, it’s all referencing out-of-pocket expense prior to cost sharing. However, there is an important distinction between how each community applies this out-of-pocket amount. Most communities treat it like an insurance annual deductible, it’s an amount paid annually before sharing is possible. However, there are communities that apply out-of-pocket expense to each major medical event, unrestricted by arbitrary annual limits, so pay attention, this can make a huge difference in your overall out-of-pocket expense.

- Provider Fee: It may be called by different names by different communities, but this is an out-of-pocket payment equivalent to an insurance co-pay but it typically only applies toward the cost of an office visit, not surgery procedures or hospital stays. Some sharing communities do not have such a fee.

- Co-share: It may be called by different names by different communities but is equivalent to co-insurance in traditional health insurance. It is the portion of medical costs shared by the member after their initial out-of-pocket is paid. Some sharing communities do not have such a fee.

- Membership: Sharing communities require a monthly “contribution” to maintain an active membership in the community. Each community has their own unique criteria for determining this amount.

What To Consider When Deciding What is Best For You:

- Cost of Acquisition: The monthly cost of coverage is important, and medical cost sharing communities certainly excel in this area, but it’s not the most significant factor in the decision process. Traditional health insurance has many hidden costs tied to utilization of medical services which significantly increase out-of-pocket expense for the insured and is the primary reason the cost of services cannot be accurately provided in advance..

- Cost of Utilization: This is a crucial consideration when evaluating coverage. The hidden costs of use inherent with insurance drastically inflates out-of-pocket expenses. The recurring nature of annual deductibles place huge financial responsibility back on the policyholder, particularly when treatment for major medical conditions lasts into the subsequent year. Copays and coinsurance perpetually increase out-of-pocket expense until the policy maximum is reached.

- Coverage: Review the scope of services offered based on flexibility in selecting your own providers, the ability to make your own healthcare decisions, fast affordable access to services, and the speed and efficiency of processing claims..

- Care Navigation: The level of personal support received while moving through the complexities of the healthcare industry.

- Transparency: Consider the options in terms of costs and coverage for a clear understanding and expectation when services are complete.

- Stability and Reliability: Review the financial stability, and customer satisfaction ratings for the companies you are considering.

- Regulatory Compliance: Ensure the options comply with relevant healthcare regulations and requirements.

Optimal teleHealth’s Approach:

At Optimal teleHealth, we have created an innovative approach that prioritizes fast access to quality care with control of the costs. In other words, we place members in control of their own healthcare. It begins with our evaluation and selection of the best Next Generation Healthcare providers in the nation, then merging their services together to deliver unparalleled flexibility in achieving optimal outcomes for our members. Sedera, our Medical Cost-Sharing Community, manages the cost sharing community and their administrative needs. Sedera provides oversight to assure members are receiving an accurate diagnosis and appropriate treatment plan, as well as fair prices for medical services. Sedera never leaves their members without support in navigating the unfamiliar territory of the healthcare industry. This provides consistency on how consumers utilize medical services, thereby significantly reducing out-of-pocket expenses common to traditional health insurance and legacy sharing communities who use models similar to insurance.

Sedera’s unique characteristics include:

- No Annual Deductible: Sedera asks members to pay a much smaller out of pocket amount every time they experience a NEED. Sedera calls this out-of-pocket amount an IUA (Initial Unshareable Amount). The amount of an IUA is determined by the membership selected, which ranges from $500-$5,000.. Once the IUA is paid, it never has to be paid again for the same NEED, even if treatment for that NEED lasts multiple years.

- Limited Max Out-of-pocket: The IUA only has to be paid three times a year per family. If a member‘s family has more than three NEEDS in one year, the cost of additional NEEDS are 100% shareable. This limits max annual out-of-pocket for major medical events to three times their IUA.

- No Co-Insurance & Co-Pay: Sedera has nothing equivalent to co-insurance or co-pay. Once the IUA is paid, the rest of all covered expenses are shared with the community.

- No Annual Renewal & Rate Increases: Sedera has no annual renewal, as long as monthly contributions are paid, the membership remains in effect. Rates are only increased when the actual cost of medical services increase.

- Monthly Contribution:This amount is determined by the members chosen IUA, members age and how many family members are included in membership; Member, Member + Spouse, Member + Child(ren), or Member + Family.

- Pre-Existing Conditions: Sharing communities must protect themselves against anyone who might receive a major medical diagnosis and join the community for inexpensive coverage. Sedera does not refuse membership because of pre-existing conditions. Among other medical cost-sharing communities, Sedera is the most permissive:

- Months 1 thru 12: no sharing

- Months 13 thru 24: max $25,000 sharing

- Months 25 thru 36: max $50,000 sharing

- Month 37+: 100% sharing

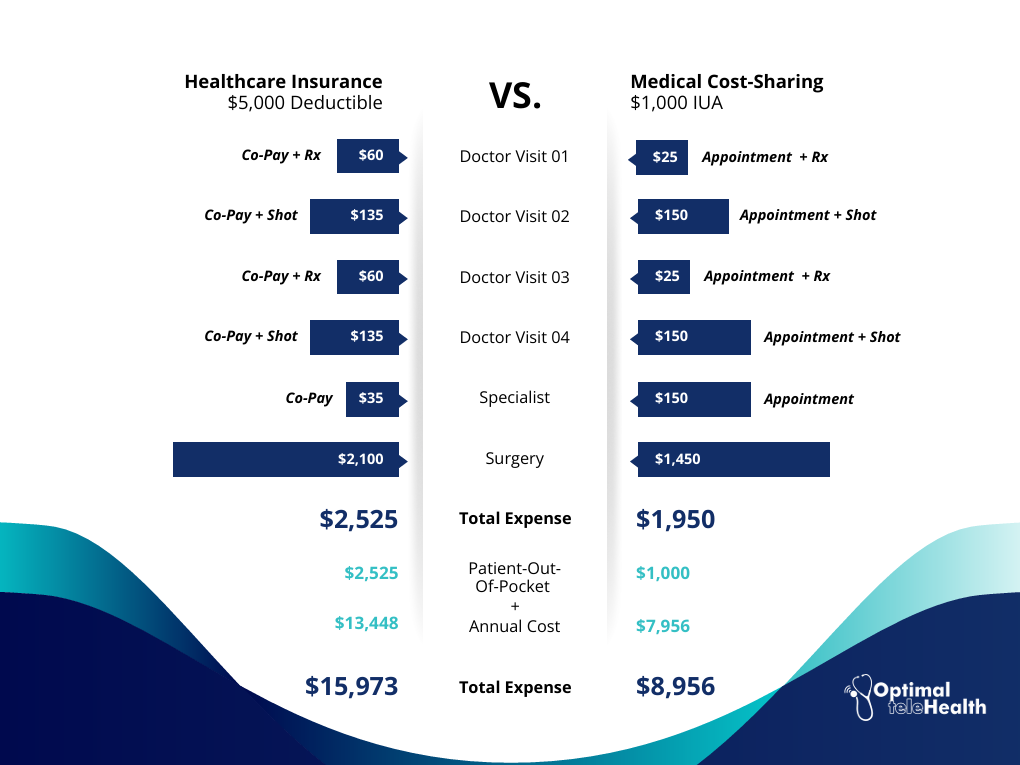

Scenario #1

This scenario involves a family whose small child suffered from repeated ear infections. After multiple trips to the doctor for treatment they were referred to a specialist who recommended the insertion of ear tubes.

Medical Cost-Sharing vs. Healthcare Insurance Comparison Chart

This procedure took place late in the year and after the first of the next year, the ear tubes fell out. The surgery was repeated, and because it was a new year and the insured’s annual deductible had started over, the insured’s family had to pay for all costs out-of-pocket, where the family using cost sharing had no additional expense.

At Optimal teleHealth, we believe in empowering and providing financial solutions for our clients to invest in their health proactively, without the fear of financial strain. Our clients find not only a pathway to significant financial relief but also access to comprehensive, quality care tailored to their needs. This innovative approach dismantles the notion that one must choose between cost and quality, proving that with the right model, it’s entirely possible to have the best of both worlds.

To learn more about how medical cost-sharing works and if it’s right for you check out our blog, 5 Steps To Take To Ensure Medical Cost-Sharing is Right For Your Business.